Phuket Today: A Unique Blend of Resort Lifestyle, Infrastructure, and Sustainable Investment Potential

Over the past decade, Phuket has evolved from a popular beach destination into an active and growing international real estate market supported by robust infrastructure and reliable market data. It’s now a competitive arena for both local and global developers.

The island benefits from two fundamental growth drivers that distinguish it from most Asian resorts:

- Limited land supply. Of its 543 km², only about one-third is developable, while the rest comprises protected national parks and steep hillsides—naturally restricting supply and supporting long-term price appreciation.

- Steady tourism flow, including premium segments. After removing COVID-19 restrictions, Phuket surpassed 14 million annual international visitors in 2023–2024, over 30% of whom are repeat visitors considering a second home or investment apartment.

These factors create an open yet competitive environment where timing and location are critical.

In this article, we will comprehensively cover:

- Current price ranges for condos, villas, and ultra‑luxury properties;

- Price trends over the past five years and underlying reasons;

- Key valuation metrics to avoid overpaying;

- How Undersun Estate can help turn these numbers into strategic advantage.

Ready to discover today’s high‑growth hotspots in Phuket’s market? Let’s begin.

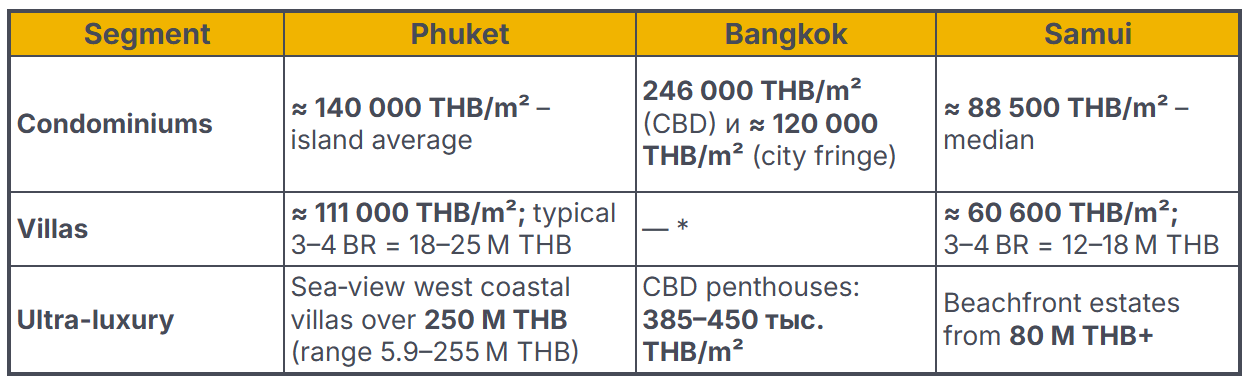

Market Overview (July 2025)

*Bangkok lacks standalone villas; instead, it offers townhouses and low-rise properties, so direct comparison is misleading.

Key Takeaways — No Fluff

- Phuket condo prices nearly match Bangkok's outskirts. At 140k THB/m², they rival Bangkok city-fringe (~127k THB) and remain below CBD levels (~236k THB). Annual growth ~3–4%, indicating steady yet controlled market expansion.

- Villas appreciate faster than condos. Median rates in Phuket are ~111k THB/m², with annual growth ~6%, driven by limited land and post-COVID demand for private homes. Samui remains cheaper (~45% lower per square meter) but has weaker infrastructure and liquidity.

- Ultra‑luxury is gaining momentum. High-net-worth individuals and family-backed investment funds from Europe, the Middle East, and Asia are competing for trophy properties. Phuket’s upper-end villa market exceeds 250 M THB, comparable to a few CBD penthouses in Bangkok.

- Samui offers a budget alternative but is less liquid and less developed than Phuket.

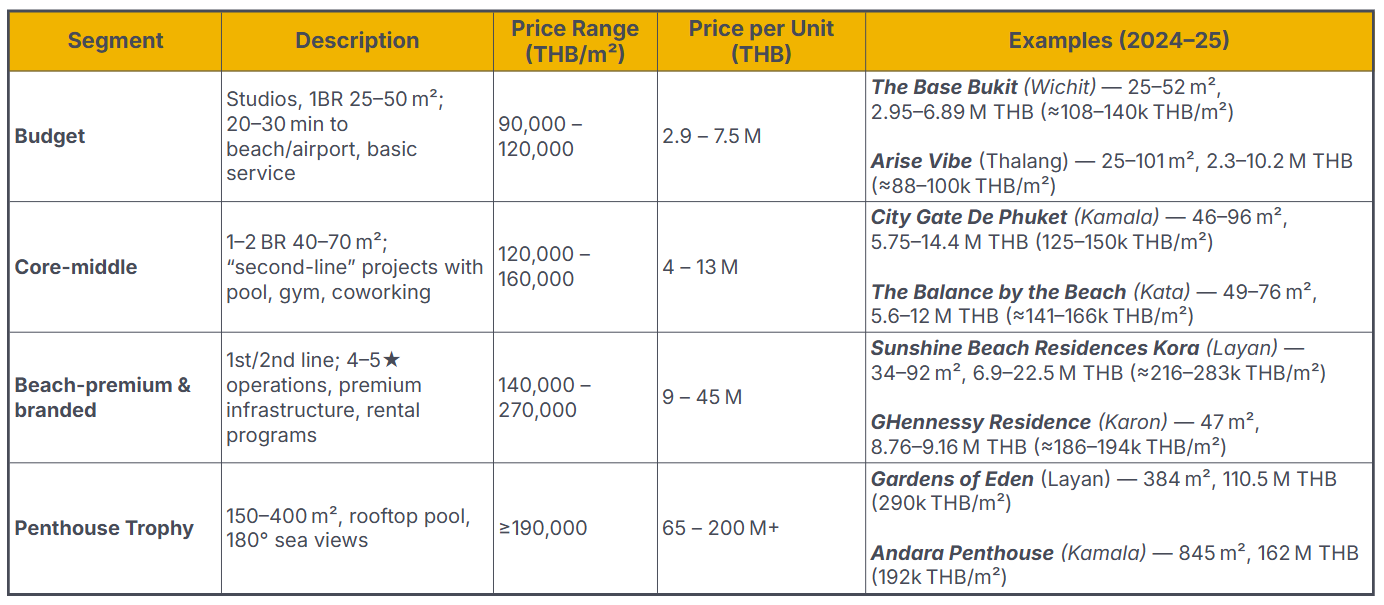

Price Ranges: Condominiums

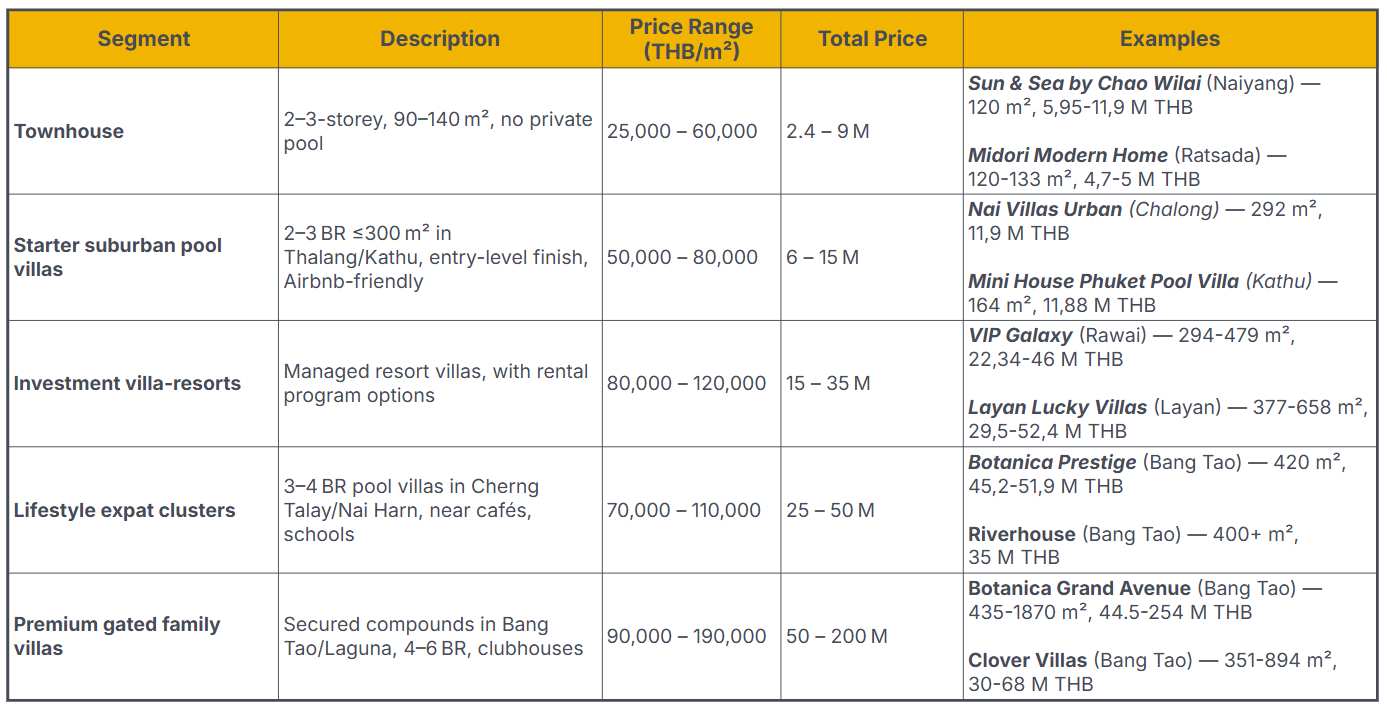

Price Ranges: Villas and Houses

Ultra-Luxury Trophy Assets

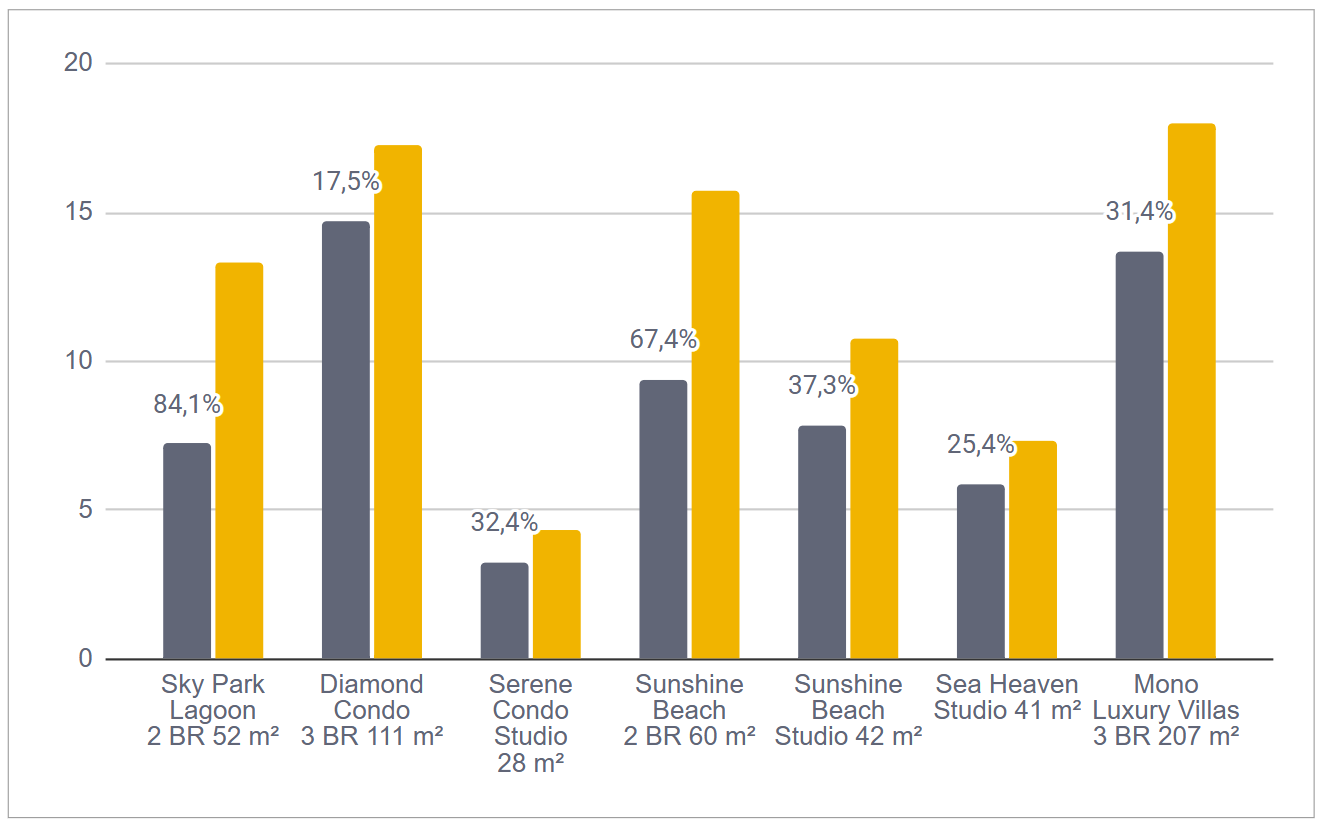

How Real Estate Prices Grew (2020–2025)

Instead of relying on average statistics, here are actual examples from developer price lists and live listings:

*Launch price during early construction or presale phase

† Actual prices as of July 2025

Key Insights from Case Studies

- Early buyers gain the most upside.

- Beachfront premium outperforms urban condos.

- Villas aren’t lagging.

Mono Villas rose 31% in 4 years—driven by land scarcity in Pasak/Choeng Thale and post-COVID preference for private land-titled homes.

- Even resale condos can show healthy appreciation.

Conclusion: Over a 5-year horizon, real resale data supports average capital gains of 25–85%, depending on entry stage and location. This aligns with macro trends and reinforces that early purchase + right location = maximum upside.

In the next section, we’ll explore which areas of Phuket (Bang Tao, Kamala, Nai Yang, Rawai) are currently driving the main price upside and what makes each of them unique.

Growth Corridors: How Property Prices Vary by Phuket Location

Bang Tao / Laguna. The island’s “golden triangle”: golf courses, 5★ hotels, and a private lagoon.

- New condo price: ≈133,000 THB/m². Villa prices: vary widely—mass-market median ≈56,600 THB/m²

- High-end villas: 100–140k THB/m²+. Due to limited land, new developments often emerge from hotel/villa redevelopment.

Kamala & Surin (Millionaire’s Mile). Hillsides with panoramic Andaman views = trophy property zone.

- Condo prices in branded projects (e.g., MontAzure, Andara): ≥200,000 THB/m²

- Market average: ≈112,000 THB/m²

- Villas: ≈80k THB/m² for older, ≥160k THB/m² for new sea-view properties

Almost all buildable plots are taken — each new site adds scarcity and boosts value.

Rawai & Nai Harn. Family-friendly south: international schools, Chalong marina.

- Average condo price: ≈92,000 THB/m²

- Villas: ≈56,000 THB/m²

Strong expat rental demand (8–10% yield), low-rise buildings preserve green views.

Nai Yang & Mai Khao. North coast near airport and Sirinat National Park.

- Budget studios from <3 M THB

- 15–20% cheaper than west coast

Growth potential linked to airport expansion and Thalang logistics zone.

Phuket Town & Kathu. Business & university zones with colonial heritage.

- Average condo price: ≈96,000 THB/m²

- Townhouses: 30–60,000 THB/m²

Price driver: historic quarter renovation + future light-rail line to airport.

*The median villa price includes all types of houses; sea-view villas on the western slopes are significantly more expensive.

How Investors Can Use Market Geography

- High capital gain (fast value growth): Buy presale <300 m from Bang Tao / Kamala beaches

- Cashflow with low risk: Ready-to-rent villa or condo in Rawai / Nai Harn

- Budget entry with upside: Studio in Nai Yang — lowest entry price, high airport-linked upside

- Infrastructure bet: Along future Phuket Town light-rail line — price lift expected post-construction start

Thus, the western beaches remain a "turbo zone" for capital appreciation, the south serves as a quiet haven for stable rental income, while the north and central areas offer a last chance to enter at pre-crisis prices before the next wave of infrastructure development.

Top 7 Drivers That Move Phuket Property Prices

- Beach proximity & sea views

First-line properties command 20–30% premium over second-line. Panoramic views on Kamala/Surin hills drive faster price appreciation.

- Branded residence management

C9 Hotelworks (2024): median price of branded condos = ≈160,700 THB/m², 25–35% higher than similar unbranded units.

- Project stage

Presale or early-construction offers 10–25% discounts vs. completion prices.

- Ownership format (Freehold vs Leasehold)

Foreign freehold quota (49%) commands a premium and better resale liquidity.

- Surrounding infrastructure

International schools (ISP, UWC), malls, and light-rail lines all boost liquidity and prices.

- Currency dynamics

Foreigners buy in THB, but currency shifts matter. Weak baht (e.g., Q1 2024) = 3–5% invisible discount, stimulating demand.

- Construction costs

Cement & steel up +15% (2023) = developers adjust prices mid-project. Early buyers lock in costs pre-inflation.

By understanding exactly how each factor adds to—or, conversely, shaves off—percentage points from the price, a first‑time buyer avoids overpaying, while a professional investor can more quickly spot a “pricing gap”: properties whose growth potential hasn’t yet been priced in.

Phuket property prices continue steady growth — and the best entry points are still available. Contact Undersun Estate via Whatsapp — or the website form — we’ll send you 5 tailored listings based on your goals and budget, with income projections and pre-increase reservation.

List of Sources: