For most foreign investors, buying property in Phuket is not only a way to secure a vacation home, but also a smart investment strategy. The island continues to attract attention from both tourists and investors due to its steady real estate growth and strong rental demand. One of the most popular strategies is to buy property for the purpose of generating rental income. For potential investors, it is crucial to understand how profitable such investments can be. In this article, we’ll explain how ROI (Return on Investment) is calculated, how much you can realistically earn from renting out property in Phuket, what factors affect profitability, and what to consider when estimating returns.

1. How Is ROI Calculated in Property Rentals?

ROI is the percentage return on your investment. To calculate rental ROI, we use the following formula:

ROI = (Annual Rental Income − Annual Operating Expenses) / Property Price × 100

To accurately estimate profitability, all income and expenses must be factored in.

What Determines Rental Income and Rental Rates

Rental income in Phuket depends on several key factors influencing both the rate and the overall revenue:

- Property Type: Studios, 1-bedroom units, villas, and penthouses all command different rates. Studios and 1-bedroom units usually have higher occupancy, while villas and larger homes may generate more income through long-term or luxury rentals. Notably, 2-bedroom apartments have high rental potential due to strong demand among families and limited market supply.

- Condition of the Property: Well-renovated units with modern furniture and appliances rent for more than outdated ones.

- Location: Rental prices are significantly higher in prime areas such as Patong, Kamala, and Bang Tao, close to beaches and tourist centers.

- Seasonality: During the high season (November to March), daily rates can be 2–4 times higher than in the low season. Annual income should be calculated month by month, taking seasonal fluctuations into account.

- Complex Prestige and Amenities: Projects with pools, gyms, restaurants, and a solid reputation can charge higher rates and attract tenants willing to pay for premium services.

- Hotel License and Brand: Developments with a hotel license or strong brand recognition can charge more due to added service, reputation, and tenant confidence.

- Occupancy Rate: A high rate is essential for stable income. Even with high rental prices, low occupancy can hurt profitability. The key is balance — avoid pricing too low or too high.

So, rental income is influenced by a combination of factors that should all be considered in profitability forecasts.

Cost Structure: What to Include When Estimating Returns

Costs are a vital part of ROI calculations. Key expense categories include:

- Operating Expenses: Utility bills (water, electricity), maintenance and repairs, security, and upkeep of common areas. Often, tenants cover water and electricity bills, so these may not affect the owner's ROI directly.

- Property Management Fees: If the property is managed by a company, they typically charge about 30% of the rental income.

- Taxes: In Thailand, foreigners must pay rental income tax, typically between 10–15%, depending on their tax residency status.

- Repairs and Upgrades: Keeping the property in good condition or updating interiors (renovation, décor) adds to ongoing costs.

- Insurance: Some owners insure their property — a recommended but optional expense, especially for high-value assets.

What Makes Up the Full Property Price

Total investment isn’t just the listed price — it includes additional costs:

- Furniture Package: If not included in the base price.

- Registration Tax: For leasehold — 1.1%, for freehold — 6.8%, usually split with the developer (so approx. 3.4%).

- Sinking Fund: Typically 1,000 THB per sq.m when purchasing a condo.

- Meter Installation: Water and electricity meters usually cost around 20,000 THB.

This total cost is used when calculating ROI.

2. ROI Calculation for a Real-World Property

How much can you actually earn renting property in Thailand?

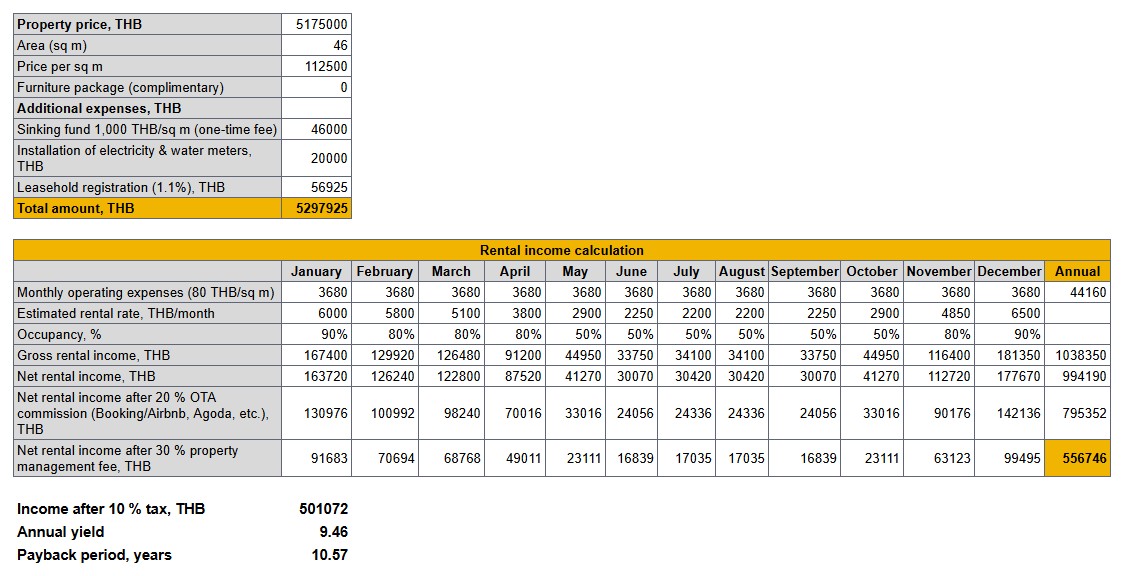

Let’s look at a real example: a 1-bedroom apartment in City Gate, 46 sq.m.

City Gate is a project by a reputable developer, walking distance to the beach in the highly desirable tourist area of Kamala. It offers stable rental income and excellent long-term capital growth potential.

Current apartment price: 5.175 million THB (with a special discount for Undersun Estate clients). The furniture package is included. Additional costs:

- Meter installation: 20,000 THB

- Sinking fund: 46,000 THB

- Leasehold registration tax: 56,925 THB

Total investment: approximately 5.3 million THB

Monthly Expenses:

- Maintenance Fee: 80 THB/sq.m (total 3,680 THB/month)

- Management Fee: 30% of rental income

Rental rates range from 2,200 to 6,500 THB/day, depending on the season (based on averages for similar units in the same project). Expected occupancy varies from 50% to 90%, also season-dependent.

Rental Income:

- Annual income after service and management fees: 556,746 THB

- Rental income tax: 55,675 THB

Net profit after tax: 501,076 THB

ROI Calculation:

- Net ROI: 9.46%

- Payback period: 10.57 years

As shown, the payback period is about 10.57 years, which is a strong result for resort real estate. And with rising rental rates in future, this could shorten.

In upcoming articles, we’ll explore ways to accelerate payback and examine additional factors that impact profitability.

👉 If you'd like a personalized ROI breakdown based on your criteria, submit a request on our website or message us directly. We'll help you find a project that matches your goals and investment strategy.